What Makes a Subprime Auto Lead Verified? In today’s competitive car market, dealerships don’t just need more leads—they need better leads. Especially when working with buyers who have credit challenges, the difference between a recycled form and a subprime auto lead that’s verified can mean the difference between a closed deal and a wasted call.

If you’re a dealership looking to scale special finance operations, you already know the term “subprime auto lead.” But what actually makes a lead verified? What qualifies it to be worth your team’s time and budget?

This guide will break it down—covering verification processes, buyer intent signals, and how a verified subprime auto lead outperforms traditional form fills across every key metric.

💡 Whether you’re using a CRM or juggling spreadsheets, learning how to spot a real subprime auto lead will sharpen your strategy—and boost your ROI.

What Is a Subprime Auto Lead?

A subprime auto lead refers to a car buyer with a credit score under 620 who is actively seeking vehicle financing. These buyers represent a large segment of the market and often rely on special finance programs, Buy Here Pay Here dealers, or franchise stores with subprime acceptance.

What makes these leads tricky—but valuable—is that they require careful screening. Many sources offer unverified, recycled, or outdated contact info that leads nowhere. But when the lead is verified, a subprime auto lead can turn into a high-intent buyer ready to fund and drive.

✅ The key difference is verification—without it, even the most promising subprime auto lead becomes a dead end.

What Does Verified Really Mean?

Auto marketing refers to all strategies car dealers use to attract, engage, and convert buyers — including digital ads, SEO, CRM automation, social media, and email outreach.

Auto marketing refers to all strategies car dealers use to attract, engage, and convert buyers — including digital ads, SEO, CRM automation, social media, and email outreach.

A verified subprime auto lead is a real buyer—not just data. They have:

- Provided a soft credit pull or declared score

- Given TCPA-compliant consent to be contacted

- Matched your inventory or service area

- Expressed financial details like down payment or monthly budget

- Been delivered to your CRM or BDC in real time

This level of intent is what transforms a regular name on a list into a qualified subprime auto lead with real financing potential.

The Features That Define a Verified Subprime Auto Lead

Let’s break it down even further:

- Credit Screening: Whether by soft pull or self-declared score, each subprime auto lead includes credit data that aligns with your lender programs.

- Location Match: You’ll receive leads in your zip code or radius, increasing local relevance.

- Real-Time Delivery: The best subprime auto lead providers offer live transfers or immediate CRM drops—timing is critical.

- Compliance: All verified leads include TCPA-consent, protecting your dealership from costly legal risk.

Exclusivity: You won’t compete with five other dealers. Each subprime auto lead is exclusive.

Who Should Use Verified Subprime Auto Leads?

- Buy Here Pay Here Dealers benefit from exclusive leads that match their approval criteria.

- Franchise Dealers need a steady flow of screened subprime auto lead submissions to maximize lender fit.

- Independent Special Finance Stores thrive when they stop chasing cold lists and start closing on buyers who were filtered for intent and budget.

If you serve buyers with credit challenges, a verified subprime auto lead strategy is your secret weapon.

How Verified Leads Perform

Real-world example:

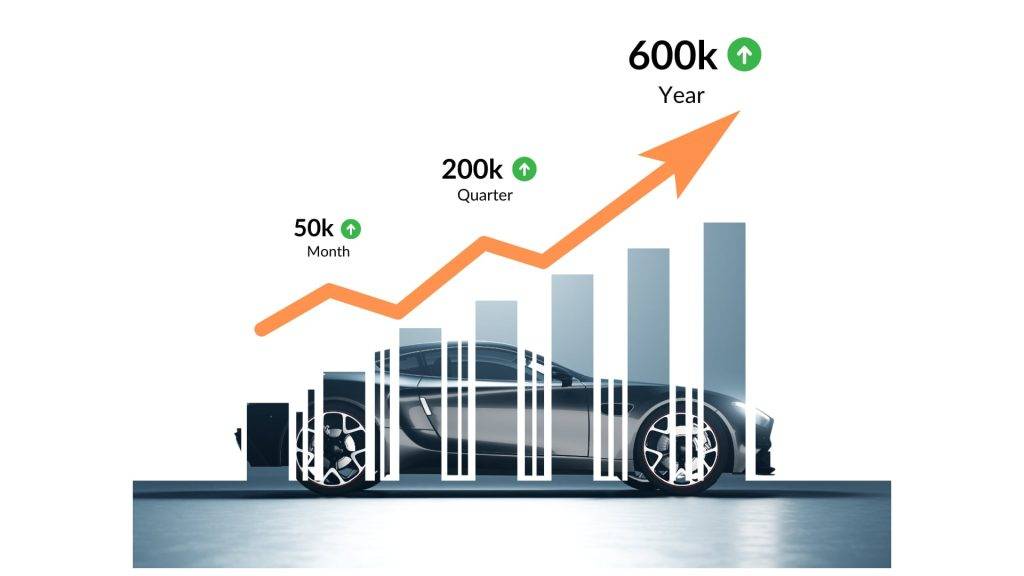

After switching to verified subprime auto lead sources, one Southeast U.S. dealership:

- 💥 Boosted contact rate by 2.5x

- 💥 Cut cost-per-sale by 40%

- 💥 Booked appointments within minutes—not hours

All from using data-backed, time-stamped, exclusive subprime auto lead streams instead of cold-form submissions.

Verified vs. Traditional: What’s the Difference?

Feature | Verified Subprime Auto Lead | Traditional Lead |

Real-Time Delivery | ✅ Yes | ❌ Delayed |

Exclusivity | ✅ One dealer | ❌ Shared |

Compliance | ✅ TCPA-verified | ❌ Not guaranteed |

Buyer Intent | ✅ High | ❌ Uncertain |

The data speaks for itself: the quality of a subprime auto lead directly affects contact rates, show-up rates, and close percentages.

Key Features of a Verified Subprime Auto Lead

So, what separates a verified lead from the rest of the pack? Let’s break down the core features that define a truly qualified, finance-ready subprime auto lead.

🔎 1. Credit Profile Match (Soft Pull or Self-Reported Range)

Every verified subprime lead includes either a soft credit pull or a self-reported score range. This allows your team to quickly assess whether the buyer fits within your dealership’s finance programs—without wasting time on out-of-range applicants.

Example: “This buyer reports a 580 score and $2,000/month income. Great fit for your second-chance lending options.”

📍 2. Location and Inventory Relevance

Verified leads are matched by zip code, city, or radius—and are often filtered to align with vehicle availability at your store. This means the buyer is not only interested, but interested in what you actually offer.

This reduces friction, improves appointment set rates, and builds trust in your first interaction.

📞 3. Real-Time Delivery (Often with Live Call Transfers)

The most powerful element of a verified lead is speed. The moment a buyer fills out their form, their information is passed directly to your team—sometimes with an instant phone call transfer.

Why does this matter? Research shows that contacting a buyer within 5 minutes increases your odds of reaching them by over 400%.

📈 That’s a game-changer for your BDC.

✅ 4. TCPA-Compliant Consent

Compliance isn’t optional—it’s mandatory. Verified leads always include:

- Consent for contact via phone, email, or SMS

- Timestamped form submissions

- Clear opt-in language per TCPA and FCC guidelines

This protects your dealership from legal issues while ensuring you’re reaching buyers who expect your call.

♻️ 5. Exclusivity

No more battling 4 other dealerships for the same lead. Verified subprime auto leads are delivered exclusively to one dealer—you.

This exclusivity boosts appointment success, reduces ghosting, and gives your team the edge.

🔐 6. Intent-Driven Behavior

These leads aren’t casually browsing—they’ve:

- Selected a vehicle or body style

- Indicated a down payment or monthly budget

- Expressed a desire to speak with someone now

🔑 That’s what separates a lead from just a name.

📊 The Impact of Verified Leads on Dealership Performance

Let’s go beyond theory. Let’s answer the real question: What Makes a Subprime Auto Lead Verified? And more importantly—how does that impact real dealership performance?

📍 Case Snapshot: Southeast U.S. Independent Dealer

This dealership didn’t just guess What Makes a Subprime Auto Lead Verified?—they tested it.

Before AutoLead Pro:

Generic form leads

15% contact rate

8% show rate

High cost-per-sale ($700+)

After using verified leads based on the principles of What Makes a Subprime Auto Lead Verified?:

38% contact rate

30% show rate

Cost-per-sale cut to under $400

Team closing deals same day as inquiry

This is what happens when a dealership finally understands What Makes a Subprime Auto Lead Verified? and applies that insight to every lead.

🔁 Why This Works:

Real-time delivery = faster follow-up

Credit match = better lender fit

Exclusivity = less competition

Compliance = safer contact practices

When you’re clear on What Makes a Subprime Auto Lead Verified, your entire workflow changes. Dealerships using verified leads don’t just close more—they close smarter.

🚗 Who Should Be Using Verified Subprime Auto Leads?

The short answer? Anyone who wants to close more deals and stop guessing What Makes a Subprime Auto Lead Verified? every time a lead comes in.

Let’s break it down by type:

🔹 Buy Here Pay Here (BHPH) Dealers

These stores often ask What Makes a Subprime Auto Lead Verified? because every wasted lead is lost time and revenue.

Verified leads help by connecting you with buyers who:

Have verified income

Show vehicle interest

Are ready to talk now

No guessing. Just leads that check every box under What Makes a Subprime Auto Lead Verified?

🔹 Franchise Dealerships Offering Subprime Financing

Your F&I team needs consistent, lender-matching traffic. Understanding What Makes a Subprime Auto Lead Verified? allows your store to:

Filter leads by credit and financing intent

Focus on buyers matched to your inventory

Deliver more consistent finance deals

Once your store adopts the mindset of What Makes a Subprime Auto Lead Verified?, you’ll see the backend grow, faster.

🔹 Independent Dealerships Focused on Special Finance

Smaller teams can’t afford bad data. These dealers benefit most by learning What Makes a Subprime Auto Lead Verified?—and then making it the rule, not the exception.

Less time wasted on cold forms

More serious appointment sets

Faster funding and better lender fit

In a competitive space, knowing What Makes a Subprime Auto Lead Verified? is what separates the lot that’s just surviving… from the one that’s scaling.

🛠 CRM-Friendly + Easy Integration helps What Makes a Subprime Auto Lead Verified

Verified auto leads aren’t useful unless they plug directly into your workflow. The good news? High-quality providers like AutoLead Pro deliver leads that:

- Sync with popular CRMs (VinSolutions, Elead, DealerSocket)

- Trigger instant alerts or live transfers

- Include full buyer profiles: contact info, location, credit score range, budget, and timestamp

You don’t have to reinvent your process—just feed in better leads and watch your team’s productivity rise.

⚠️ Common Mistakes When Sourcing Subprime Leads

If you’re not using verified leads yet, here’s what you want to avoid:

❌ 1. Buying from Bulk Resellers

Many lead lists are scraped or sold in batches, meaning the same person hears from 5–7 dealers. That’s not good for trust—or contact rates.

❌ 2. No Credit Screening

If your lead provider doesn’t at least ask the buyer to self-report credit or do a soft pull, you’re taking shots in the dark.

❌ 3. Lack of Compliance

No TCPA documentation? No timestamp? That’s a legal risk you don’t want.

🧠 Smart Dealers Use Verified Leads to:

- Pre-qualify before the first call

- Match buyer interest to inventory

- Increase contact rates and reduce ghosting

- Spend marketing budget where it counts

🔑 Closing deals starts with connecting to the right buyers, not just more of them.

Verified vs. Traditional Subprime Leads: What’s the Real Difference?

You’ve probably heard the terms thrown around—“a lead is a lead,” or “you just have to work them harder.”

🚫 Wrong.

In today’s dealership environment, What Makes a Subprime Auto Lead Verified is the difference between mediocre sales results and a predictable pipeline of closable deals. It’s a question that defines the quality of your marketing, your team’s efficiency, and ultimately, your bottom line.

There’s a major difference between traditional subprime leads and leads that have been carefully filtered through the lens of What Makes a Subprime Auto Lead Verified—and only one gives your sales team a real shot at high-return, repeatable outcomes.

Let’s break it down 👇

🔍 Verified Subprime Leads

| Feature | What You Get |

|---|---|

| Credit Match | Yes – Soft pull or self-declared score |

| Exclusive | Yes – Sent to only one dealer |

| Delivery Speed | Instant – Often real-time or live transfer |

| Compliance | TCPA-consented + timestamped |

| Intent | High – Buyer actively searching now |

| CRM Integration | Seamless (email, API, call routing) |

| Close Rates | Higher (15–30% on average) |

❌ Traditional Subprime Leads

| Feature | What You Get |

|---|---|

| Credit Match | Often unknown or not included |

| Exclusive | Usually sold to multiple dealers |

| Delivery Speed | Delayed – sometimes hours or days |

| Compliance | May lack proof of consent |

| Intent | Mixed – no clear indication of readiness |

| CRM Integration | Manual export/import process |

| Close Rates | Lower (5–10% or less) |

🎯 The ROI Advantage

The biggest factor behind high-performing stores isn’t just volume—it’s understanding What Makes a Subprime Auto Lead Verified and leaning into it.

A dealership using verified subprime leads aligned with What Makes a Subprime Auto Lead Verified typically sees:

⏱ 2x faster response times

📞 Up to 3x higher contact rate

💸 Lower cost per acquisition

🤝 Stronger sales team morale (less chasing, more closing)

If you’re investing heavily in marketing but not seeing the return, it’s time to ask:

👉 What Makes a Subprime Auto Lead Verified? The answer could redefine your approach.

💬 Don’t Take Our Word for It

Here’s what dealers across the country are saying since focusing on What Makes a Subprime Auto Lead Verified:

“We used to spend hours each day on leads that went nowhere. Now we get matched with buyers who are serious, not just browsing—AutoLead Pro makes that possible.”

— Alex T., Special Finance Manager, Midwest

“Once we added real-time transfers to our workflow, our BDC’s productivity jumped. We book more appointments and get more people funded.”

— Samantha R., GM, Texas Independent Store

🔗 Ready to Go Verified?

If you’ve been asking yourself What Makes a Subprime Auto Lead Verified, now’s the time to experience it firsthand.

👉 Discover Verified Subprime Leads Now

With AutoLead Pro, you’ll get:

🚗 Real-time delivery

🔒 TCPA-compliant, credit-matched buyers

🔁 Seamless CRM integrations

📈 A clear path to higher conversions

🛠 Advanced Dealer Strategies for Boosting Verified Lead Performance

Even with verified subprime auto leads in place, top-performing dealerships know there’s more to success than just receiving names in a CRM. The real difference lies in strategy—how you engage, qualify, and nurture those leads through the sales funnel.

To help you get ahead, here are several high-impact techniques used by dealerships leveraging cutting-edge digital tools and auto-specific marketing platforms.

🎯 Utilize Auto Dealer Online Marketing for Smarter Outreach

Auto dealer online marketing isn’t just about flashy inventory ads—it’s about targeting the right audience with the right message at the right time. By combining your verified leads with strategic car dealer internet marketing, you’ll increase engagement and streamline follow-up processes.

💼 Scale with the Best Auto Dealer Lead Providers

Don’t settle for one-size-fits-all lead companies. The best automotive lead providers specialize in high-quality subprime car leads and offer flexible plans based on your inventory size, geography, and finance structure. Look for providers that integrate easily with your CRM and offer support in lead management workflows.

🔍 Improve ROI with Automotive Data Mining and Equity Mining Tools

Smart dealers are using automotive data mining software to identify equity positions that align with financing opportunities. With tools like equity mining automotive systems, you can tap into your existing customer base to generate new finance leads—even before they start shopping elsewhere.

🧠 Automate Smart Touches Using Car Sales Leads App Integrations

Sales reps benefit from automation. A good car salesman lead generator includes tools like autoresponders, email drip campaigns, and SMS scheduling. Many of the top platforms include a car sales leads app that connects all communication tools into one easy-to-use dashboard.

📈 Track Performance with Lead Generation for Car Dealers

Effective lead generation for car dealers requires more than inbound traffic—it demands performance measurement. Use data insights to monitor which auto car leads are converting, and focus your time on high-performing sources.

💡 Pair Verified Leads with Car Marketing Services for Maximum Reach

A verified lead is just the start. Car marketing services help you retarget website visitors, set up dynamic remarketing ads, and use content to educate subprime buyers. These services increase your dealership’s visibility in competitive markets and complement your auto sales advertising strategy.

🚘 Attract Buyers with Auto Broker Software and Buy Car Leads Funnels

By pairing auto broker software with smart marketing, dealerships can generate targeted funnels to buy car leads from private sellers looking to trade. This widens your reach and gives your sales team a consistent stream of qualified used car leads.

📣 Don’t Ignore Dealer Marketing Services for Your BDC

Dealer marketing services are essential when it comes to managing and qualifying leads at scale. They support your team with scripts, email templates, and campaign timing suggestions—essential when working high-volume leads such as auto dealer lead generation campaigns.

📊 Integrate Automotive Marketing Platforms with Lead Generation Tools

Whether you’re a franchise or independent lot, using an integrated automotive marketing platform ensures all lead sources—from special finance car leads to subprime buyer inquiries—are centralized. The easier it is to manage your pipeline, the faster you can convert interest into appointments.

🚀 Looking to Get Better Results?

If you’re searching for a way to improve your results with subprime auto leads, you’re not alone. Many dealerships struggle to connect with qualified buyers who are actually ready to talk. That’s why more dealers are shifting to a verified auto leads system that eliminates cold forms and delivers higher buyer intent.

Whether you’re running a franchise location, a Buy Here Pay Here lot, or an independent store focused on special finance, it’s essential to focus on lead quality—not just volume. Learn how verified subprime auto leads are helping dealerships increase approvals, lower acquisition costs, and speak with buyers in real time.

Frequently Asked Questions (FAQ)

❓How is a verified subprime auto lead different from a regular one?

A verified subprime auto lead is a buyer who has submitted recent interest, includes a soft credit pull or declared score (typically under 620), provides full contact info, and has been matched based on location, inventory, and compliance with TCPA regulations.

❓How are verified leads different from regular leads?

Verified leads are filtered, exclusive, and real-time—meaning they’re matched to your finance program and inventory. Traditional leads are often shared, outdated, and lacking credit context.

❓Do I need a call center or CRM to work with verified leads?

No, but it helps. Many verified lead providers offer live transfers or CRM integrations, but smaller or independent dealers can also receive them via email, web form, or custom workflows.

❓How fast should I contact a verified subprime lead?

Ideally within 5 minutes. Real-time contact improves your chances of reaching the buyer by over 400%. Many dealers use instant alerts or live call routing to boost contact and close rates.

❓What industries benefit most from verified subprime leads?

Primarily car dealerships—especially Buy Here Pay Here, special finance departments, and independent stores. Beyond dealerships, verified leads can support auto finance companies, brokers, and CRM systems.

Looking to Grow Your Dealership Business?

Explore how Auto Lead Pro can help you generate more high-quality car leads and manage your dealership more efficiently.

Recommended Reads:

Ready to Boost Your Dealership or Find the Perfect Ride?

Whether you’re a car shopper looking for helpful tips or a dealership ready to convert more leads, Auto Lead Pro has you covered. Get expert advice, marketing insights, and updates from our team across all major platforms:

Discover fresh automotive ideas and marketing strategies on Pinterest

Stay informed with real-time updates and dealer tips on X (Twitter)

Watch lead generation tutorials and car buyer tips on YouTube

Get behind-the-scenes content and daily insights on Instagram

Connect with buyers and dealers, and see success stories on Facebook

👉 Follow Auto Lead Pro today and start turning leads into loyal customers.