As interest rates rise and lender qualifications become more selective, more New Yorkers with low credit scores are struggling to secure vehicle financing. This shift opens up a strong opportunity for dealerships willing to cater to the credit-challenged market. These buyers are actively looking for solutions—and they’re ready to purchase when they find a dealership that can help.

In 2025, knowing how to get bad credit auto leads isn’t just helpful—it’s a competitive necessity. With the right lead sources and targeted campaigns, your dealership can consistently attract qualified, credit-challenged buyers who are ready to engage.

This guide will walk you through how to get bad credit auto leads that convert, from local referral networks to digital ads and SEO strategies. Whether you’re just starting or optimizing existing efforts, we’ll show you how to get bad credit auto leads that bring consistent ROI and long-term customer loyalty.

Understanding Bad Credit Auto Leads

Understanding how to get bad credit auto leads starts with recognizing who these buyers are and what motivates them. Bad credit auto leads are individuals who are actively seeking to purchase a vehicle but have credit scores—typically below 620—that prevent them from qualifying for traditional, prime-rate financing. Despite their credit challenges, they represent a serious and motivated segment of the market.

These buyers often:

Need reliable transportation for commuting to work, managing family responsibilities, or overcoming life transitions

Are open to alternative financing options, including subprime loans with higher interest rates or flexible payment structures

Tend to develop long-term loyalty toward dealerships that treat them with respect and provide real solutions, especially during financially difficult times

If you’re aiming to grow in 2025, learning how to get bad credit auto leads that are both qualified and high in intent is crucial. These shoppers aren’t just browsing—they’re ready to buy from a dealership that understands their needs. Knowing how to get bad credit auto leads and nurture them through the sales process can help your dealership establish trust, close more deals, and build lasting relationships with a customer base often overlooked by competitors.

Why Your Dealership Should Target This Market

Focusing on credit-challenged buyers offers several advantages:

Stable Demand: Economic fluctuations and inflation have increased the number of consumers with impaired credit seeking auto loans.

Increased Profit Potential: Subprime financing often provides greater backend gross via lender programs.

Reduced Competition: Many dealerships neglect this segment, giving you a clear competitive advantage in your market.

5 Proven Ways to Generate Bad Credit Auto Leads in New York

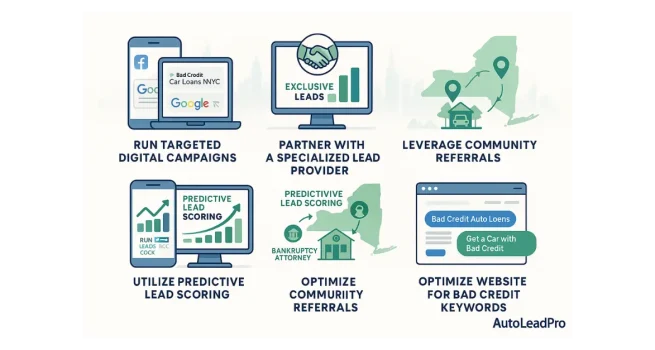

1️⃣ Launch Targeted Digital Advertising

Run high-intent campaigns on platforms like Google and Facebook. Focus on search terms such as:

“bad credit car loans near me”

“get a car with poor credit NYC”

“auto financing for bad credit New York”

Ensure that your ads direct users to landing pages built specifically for credit-challenged buyers, complete with clear next steps and financing options.

2️⃣ Partner with a Specialized Lead Provider

Working with companies that focus on subprime or bad credit leads (e.g., AutoLeadPro or similar providers) can help your sales team prioritize high-conversion prospects. These leads are typically pre-screened and have already expressed financing interest.

3️⃣ Use Predictive Lead Scoring Technology

Leverage AI-based lead scoring tools to identify which leads are most likely to convert. This helps your team focus on serious buyers and reduces time spent on unqualified traffic.

4️⃣ Build Local Referral Partnerships

Collaborate with local organizations that assist individuals rebuilding credit, such as:

Credit counseling services

Bankruptcy attorneys

Nonprofit financial assistance centers

Such partners frequently connect you with credit-challenged individuals who are actively exploring their auto financing options.

5️⃣ Optimize Your Website for Search Engines

Create or update web pages and blog posts targeting terms like:

“bad credit car loans in NY”

“auto dealers for low credit buyers”

“how to buy a car with poor credit in New York”

Organic SEO traffic from these keywords brings in highly targeted leads and enhances your dealership’s online authority.

Best Practices for Converting Bad Credit Auto Leads

Once a lead enters your funnel, your team must be properly trained to close the deal with efficiency and empathy. Set clear expectations about interest rates, down payment requirements, and the approval process timeline. Make sure your F&I managers are well-versed in subprime lending programs and capable of structuring deals that work for both the customer and the lender.

It’s also essential to communicate with transparency and respect—many subprime buyers have had negative financial experiences in the past and are cautious about entering another loan. Timely follow-ups are crucial as well; subprime shoppers often contact multiple dealerships and will move forward with the one that responds first and shows understanding.

For a deeper look into who these customers are and how they behave, check out our full guide on what subprime auto leads are.

Start Growing with Credit-Challenged Buyers in 2025

New York’s bad credit buyers present a high-value opportunity for forward-thinking dealerships. With the right strategy, tools, and partnerships, you can consistently bring in qualified leads and convert them into satisfied long-term customers.

If you’re looking to expand your reach in this segment, partnering with a reputable lead provider can help you build a steady pipeline of pre-qualified buyers.

FAQs: Bad Credit Auto Leads in New York

Are bad credit leads worth pursuing?

Absolutely. They tend to convert faster and can bring in higher back-end profits due to lender incentives and financing margins.

How do I attract bad credit buyers in New York?

Use geo-targeted online ads, SEO-focused content, and referral relationships to consistently generate interest from credit-challenged buyers.

What credit score defines a bad credit auto lead?

Typically, any score below 620 is considered subprime in auto lending.

What’s the best way to qualify these leads?

Confirm steady income, residency, and willingness to meet down payment or documentation requirements. Match them with appropriate lender programs.

Do bad credit buyers become repeat customers?

Yes—especially when treated fairly and respectfully. Many will return to your dealership for future purchases, upgrades, or service.

Social Media

Follow us for real tips, stories, and credit-friendly updates:

- Instagram: Click Here

- Facebook: Click Here