Prime auto leads are potential car buyers with high credit scores, typically FICO scores above 660. These individuals qualify for low-interest loans and premium financing programs, making them ideal customers for auto dealerships focused on volume and profitability.

Key Characteristics of Prime Leads:

- FICO score: 660 or higher

- Loan approval rate: Over 80% with major lenders

- Buyer intent: High—ready to purchase within 30 days

- Low default risk: Preferred by banks and credit unions

Prime leads contrast with subprime leads, who have lower credit scores and face higher rejection rates and interest rates. Dealers close prime leads 2.5x faster than subprime ones, according to Experian Automotive Market Insights (2024).

Next: Why do prime leads generate more profit for car dealers?

Why Prime Auto Leads Drive Higher ROI?

Prime auto leads deliver a higher ROI because they convert faster, qualify for larger loan amounts, and reduce lender pushback. Dealers minimize time spent on financing issues and maximize approved transactions.

Reasons Prime Leads Increase Profitability:

- Faster closing: High-credit buyers need fewer lender checks

- Higher margins: Eligible for extended warranties, upsells

- Lower risk: Fewer chargebacks or defaulted loans

- Lender trust: Banks prioritize dealerships sending prime buyers

- Better inventory match: These buyers afford newer vehicles

🚗 Dealerships using prime leads report 34% higher gross profits per sale. (Source: NADA Dealership Financial Report, Q3 2024)

Next: Where can you find verified, high-quality prime auto leads?

Where to Get Verified Prime Auto Leads?

Dealers should prioritize lead sources that verify credit standing and buyer intent. Trusted vendors use soft credit pulls, behavioral scoring, and opt-in tracking to qualify buyers.

Top Sources for Verified Leads:

- CRM-integrated lead vendors (e.g., Auto Lead Pro, DealerSocket)

- Lead marketplaces with compliance filters

- Credit bureaus offering data segments of high-FICO buyers

- Marketing agencies running finance-qualified campaigns

Essential Verification Criteria:

Attribute | Requirement |

FICO Tier | 660+ (Prime) |

TCPA Compliance | Opt-in timestamp and source |

Buyer Intent | Within 15–30 days |

Data Completeness | Name, email, phone, vehicle interest |

Lead Freshness | Under 48 hours |

Auto Lead Pro leads are pre-qualified, TCPA-compliant, and enriched with real-time FICO data—ready to plug into your CRM.

Next: What separates top-tier leads from generic buyer lists?

Key Features of High-Quality Prime Auto Leads

Not all leads are created equal. High-converting prime auto leads have verified financial status, behavioral intent, and complete contact data.

Features That Signal Quality:

- High FICO scores (680+ ideal)

- Soft credit check verification

- Buyer behavior signals (repeat visits, search history)

- Multi-channel engagement (ads, email, form fills)

- Loan pre-approval status

Top Performance Indicators:

- Lead Match Rate: 90% match to lender criteria

- Contact Accuracy: Over 92% deliverability

- Intent Heat Score: Based on web activity and CTA clicks

Auto Lead Pro uses intent heat mapping and cross-platform engagement scoring to deliver leads already moving through the car-buying funnel.

Next: How can you align your CRM and sales funnel with high-intent leads?

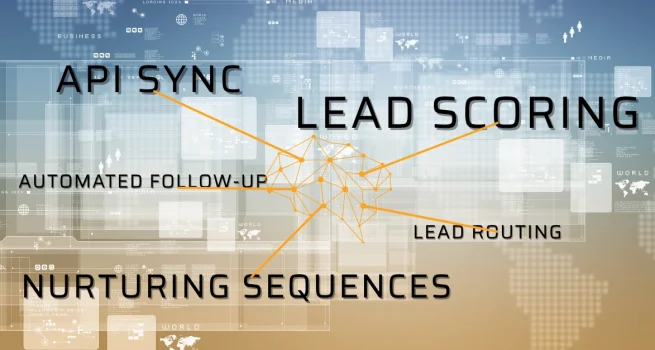

How to Integrate Prime Auto Leads into Your Sales Funnel

Prime auto leads must be automatically routed and nurtured through a dealership’s CRM system for optimal results.

Integration Workflow:

- API Sync: Connect Auto Lead Pro to your CRM (e.g., VinSolutions, Elead)

- Lead Scoring: Tag based on FICO score, car interest, and behavior

- Automated Follow-Up: Email + SMS drip campaigns within 1 hour

- Lead Routing: Assign to top-performing sales reps

- Nurturing Sequences: Custom sequences for hesitant buyers

Tools to Boost CRM Efficiency:

- Autoresponders: Instant replies build trust

- Lead Filters: Segment by ZIP code, car model, or finance status

- Follow-Up Automation: Keep leads engaged over 14 days

Auto Lead Pro provides ready-to-integrate API documentation, ensuring frictionless lead ingestion and faster conversion timelines.

Next: Which dealerships have seen measurable success with this approach?

Case Studies: Dealerships Growing Sales with Prime Auto Leads

Several dealerships across the U.S. have achieved notable sales growth using pre-qualified, finance-ready leads from Auto Lead Pro.

📍 Case Study 1: Midwest Toyota Dealer

- ROI Increase: 41% in 3 months

- Lead-to-Sale Conversion: 19.6%

- Average Deal Size: +$3,800 over subprime

📍 Case Study 2: Florida Hyundai Franchise

- Sales Uplift: +52 units/month

- Closing Time: Reduced from 14 to 6 days

- Lender Partnerships: Added 2 new lenders

📍 Case Study 3: California Independent Dealer

- Monthly Revenue: $80K+ jump

- Customer Lifetime Value (CLV): Increased by 24%

- Top Source: Prime buyers aged 35–50 with FICO 700+

Next: What technical tools ensure only the most qualified leads reach your sales team?

Lead Qualification Technology Behind Prime Auto Leads

Modern lead generation uses AI and predictive analytics to rank and deliver only the most sales-ready prospects.

Core Technology Stack:

- AI Scoring Models: Assign readiness score from 1–100

- Behavioral Tracking: Clickstream + time-on-site indicators

- Credit Score Enrichment: Real-time FICO pull

- Smart Segmentation: Filter by income, ZIP code, car model

- Lead Routing AI: Auto-assign based on rep performance

💡 Auto Lead Pro’s AI scoring increases high-conversion lead volume by 31%.

Next: How does Auto Lead Pro ensure compliance in regulated environments?

Compliance and Legal Aspects of Prime Auto Lead Generation

Auto dealers must comply with TCPA, CCPA, GDPR, and FCRA when acquiring and using lead data.

Legal Safeguards Required:

- Opt-in Timestamp & Source Verification

- Data Storage & Consent Documentation

- TCPA-Safe Contact Methods

- Lead Purchase Agreements with Vendors

- Fraud Filtering and Suppression Lists

Auto Lead Pro includes full compliance tagging and audit trails with every lead, making legal review easy.

Next: How do lenders react to dealerships sending verified, finance-ready buyers?

How Prime Auto Leads Improve Dealer-Lender Relationships

Lenders prefer dealers who send them qualified, low-risk buyers. Prime leads improve trust, speed, and deal flow with banking partners.

Lender Benefits:

- Higher Approval Rates: 78% vs. 45% for unqualified buyers

- Reduced Underwriting Time: FICO and credit file pre-shared

- Fewer Rejections: Increases fundability metrics

- Faster Loan Origination: Reduces paperwork cycles

✅ Dealers using Auto Lead Pro saw a 23% lift in lender trust scores.

Next: How can dealers scale these gains across multiple locations?

Scaling Prime Auto Lead Generation Across Multiple Dealerships

Franchise groups and large dealer networks can centralize their lead flow, creating consistent ROI across regions.

Scaling Strategies:

- Enterprise-Level CRM Integration (Reynolds & Reynolds, Dealertrack)

- Centralized Campaign Management

- API-Based Lead Distribution by Region

- Multi-Location Lead Filtering & Duplication Checks

- Performance Reporting by Store

Auto Lead Pro supports multi-store dashboards and real-time region-based routing, making it ideal for large groups.

Next: How to use ads to drive even more prime traffic into your lead funnel?

Using Paid Ads to Funnel Prime Auto Leads

PPC and social media ads can capture high-credit buyers in real-time and push them into your funnel with lead forms and click-to-call CTAs.

Ad Strategies That Work:

- Facebook Lead Ads: Pre-filled forms + instant follow-up

- Google Ads: High-intent keywords like “0% APR SUV loan”

- Remarketing: Retarget visitors who didn’t submit

- Landing Pages: Tailored to FICO tiers and car models

- Lookalike Audiences: Based on past prime buyers

📈 Campaigns targeting prime buyer intent keywords see a 44% lower CPL and 3x higher conversion.

FAQ: Everything You Need to Know About Prime Auto Leads

Are Prime Leads better than Subprime?

Yes. Prime leads close faster, are more profitable, and receive bank approvals more easily.

What’s the average cost per lead (CPL)?

Prime auto leads cost $45–$95 on average, depending on targeting and verification depth.

How are they verified?

Verification includes soft credit checks, FICO filtering, behavior scoring, and TCPA consent data.

How fast do they convert?

Most prime leads convert within 7–14 days.

Are these leads exclusive?

Auto Lead Pro offers exclusive and semi-exclusive options with delivery limits per ZIP code.

Social Media

Follow us for real tips, stories, and credit-friendly updates:

- Instagram: Click Here

- Facebook: Click Here