The automotive industry is highly competitive, making lead generation a crucial component of dealership success. Auto Credit Leads connect dealerships with potential buyers who require financing to purchase a vehicle. These leads are particularly valuable as they consist of customers actively seeking financial assistance, making them high-intent prospects.

Dealerships can expand their customer base, improve conversion rates, and optimize their marketing efforts. In this guide, we explore how auto credit leads work, their importance, and how dealerships can maximize their potential.

Understanding Auto Credit Leads

What Are Auto Credit Leads?

Auto credit leads refer to prospective vehicle buyers who require financing approval to complete their purchase. These leads often include individuals with varying credit histories, from those with excellent credit scores to subprime borrowers who need specialized loan programs.

Since these leads already indicate a strong intent to buy, they provide dealerships with a direct opportunity to engage qualified customers and streamline the sales process.

Types of Auto Credit Leads:

✔ Prime Credit Leads – Customers with strong credit profiles who can secure competitive loan rates.

✔ Subprime Credit Leads – Individuals with low or challenged credit scores seeking alternative financing solutions.

✔ First-Time Car Buyers – Customers with little to no credit history requiring structured financial options.

✔ Credit-Challenged Applicants – Buyers who need special financing programs due to past financial difficulties.

Why Auto Credit Leads Are Essential for Dealerships

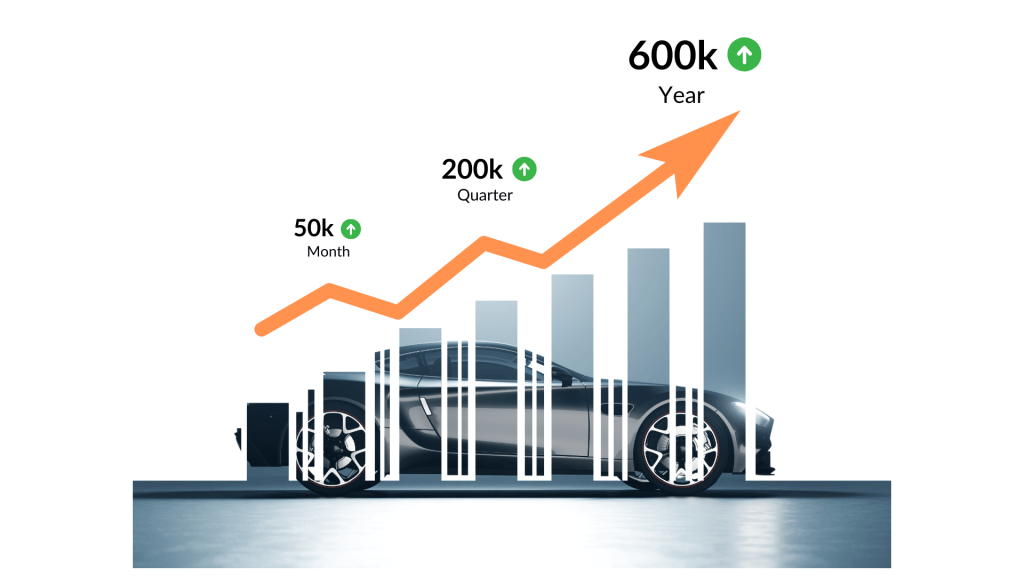

Increased Sales Potential

Since auto credit leads originate from individuals actively looking for financing, they represent a highly convertible audience. These leads have strong purchasing intent, which increases the likelihood of closing a sale.

Improved Targeting and Resource Allocation

By focusing on leads who meet specific financial criteria, dealerships can optimize their marketing and sales strategies. This ensures that efforts are directed toward individuals who are more likely to complete a purchase.

Expansion of Customer Reach

Auto credit leads allow dealerships to serve a diverse range of buyers, including those who may not qualify for traditional financing. This inclusivity broadens the dealership’s customer base.

Strengthened Customer Relationships

By offering personalized financing solutions, dealerships can build trust and long-term customer loyalty, increasing repeat business and referrals.

👉 Ready to grow your dealership with high-converting leads? Explore our Special Finance Lead Services and Contact Us Today to get started.

📲 Stay connected!

Follow us on Facebook and Instagram for more tips and updates.

Strategies for Generating Auto Credit Leads

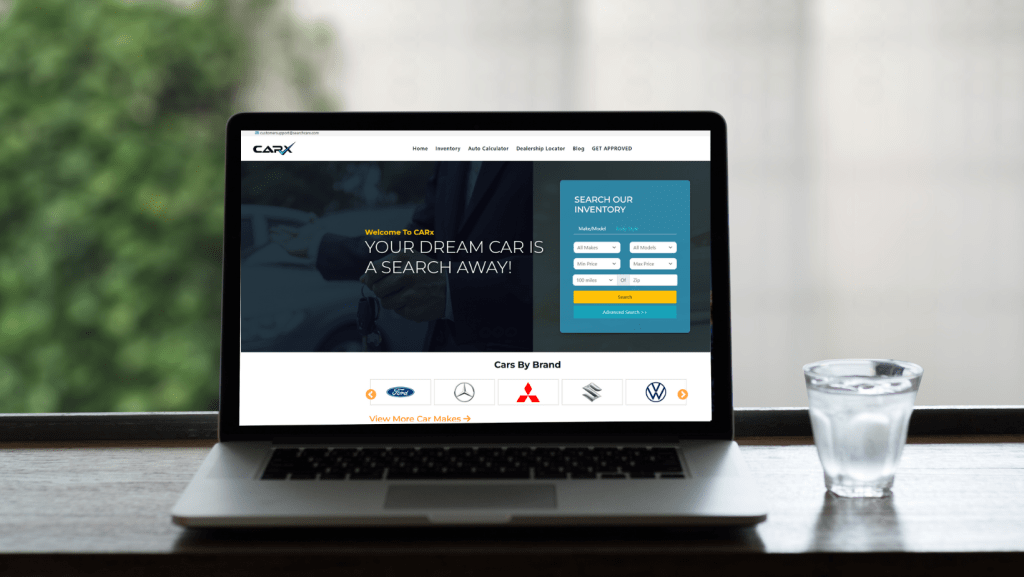

- Optimize Your Dealership Website for Lead Generation

A well-optimized website should include:

✔ Easy-to-navigate financing applications

✔ Auto loan calculators to assist potential buyers

✔ Clear call-to-action (CTA) buttons encouraging visitors to apply for financing

- Invest in Digital Advertising

Using Google Ads and social media campaigns, dealerships can reach customers searching for:

- “Bad credit auto loans”

- “Guaranteed car financing”

- “Auto credit leads near me”

- Partner with a Reputable Lead Provider

Working with a trusted lead generation service ensures that dealerships receive pre-qualified, high-intent leads, saving time and resources.

- Leverage Social Media Engagement

Social media channels such as Facebook and Instagram serve as effective tools for engagement and marketing.

📌 Promote dealership special finance programs

📌 Share customer success stories

📌 Engage potential buyers through interactive content

- Utilize Email and SMS Marketing

Sending personalized financing offers and loan approval updates can keep potential buyers engaged and encourage them to move forward with their purchase.

Best Practices for Converting Auto Credit Leads

✅ Immediate Response to Inquiries – Engaging leads promptly increases the likelihood of conversion.

✅ Customized Financing Solutions – Tailor financing plans to accommodate each customer’s credit situation and budget.

✅ Multiple Loan Options – Collaborate with lenders who provide a range of financing solutions.

✅ Consistent Follow-Ups – Maintain communication with leads through calls, texts, and emails to reinforce their interest.

👉 Ready to maximize your dealership’s success? Explore our Special Finance Lead Services and Contact Us Today to start converting more leads into buyers.

Frequently Asked Questions (FAQs) About Auto Credit Leads

Q1: How Can Dealerships Obtain Auto Credit Leads?

Dealerships can acquire high-quality auto credit leads through:

✔ Professional lead generation services like Auto Lead Pro

✔ Targeted digital advertising

✔ Social media marketing campaigns

Q2: Are Auto Credit Leads a Good Investment for Dealerships?

Yes! These leads connect dealerships with customers actively seeking financing, leading to higher sales and increased revenue.

Q3: How Can Dealerships Improve Auto Credit Lead Conversion?

✔ Immediate customer engagement

✔ Flexible financing solutions

✔ Ongoing follow-ups to nurture potential buyers

Q4: Do Auto Credit Leads Include Subprime Buyers?

Yes, many auto credit leads consist of subprime borrowers looking for flexible financing options. Special finance programs help these buyers secure affordable auto loans.

Want More Leads, Better Conversions, and Smarter Marketing?

Auto Lead Pro helps dealerships work smarter, not harder.